Trading Notes - Nov.03.2025

Notes on trading INTC and the Yen.

INTC || Leap $24 Calls for Mar.2026 & June.2026

Profit: 556%

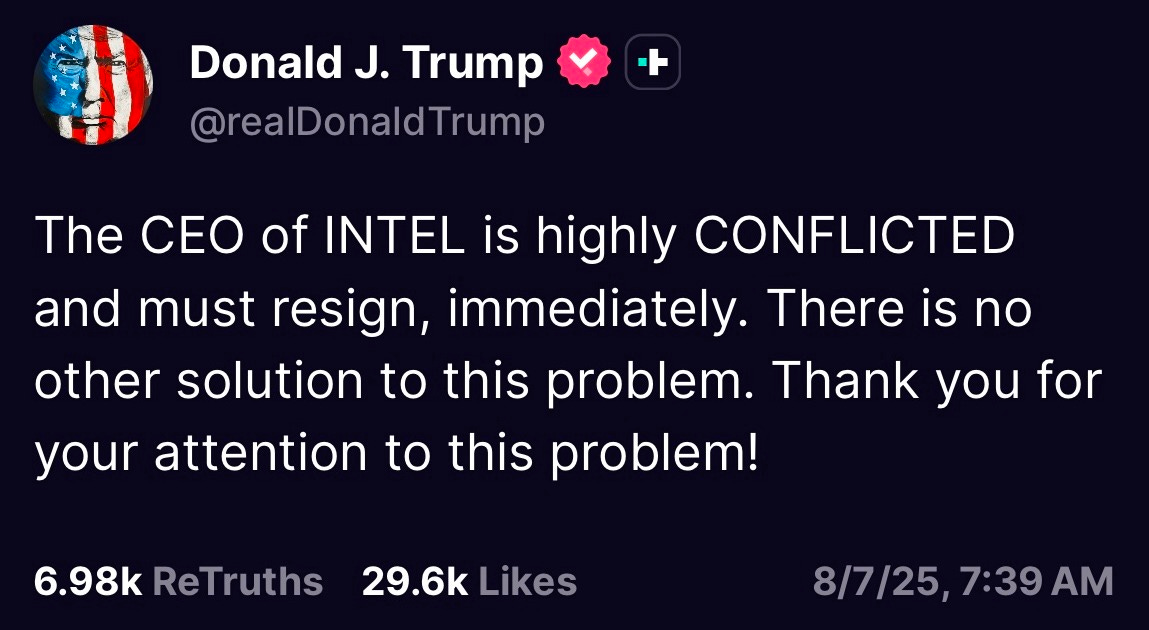

I purchased these call options in early August. What led me to to the trade was watching large blocks of INTC options being purchased over the summer. It got me thinking, what if INTC was a US re-shoring narrative? It has a foundry. Chip manufacturing is essential for national security. Any kind of China-Taiwan clash was a major risk. Why wouldn’t the US want a foundry run by an American company on local soil. As I was mulling it over, I saw President Trump start to mention INTC on Truth Social.

It was game on.

I’ll reiterate that I have ZERO edge on stock valuations. I don’t know what the fair price for a stock should be. This trade was led by my gut. I had a feeling something was bound to happen on INTC. What that something was though, I wasn’t sure.

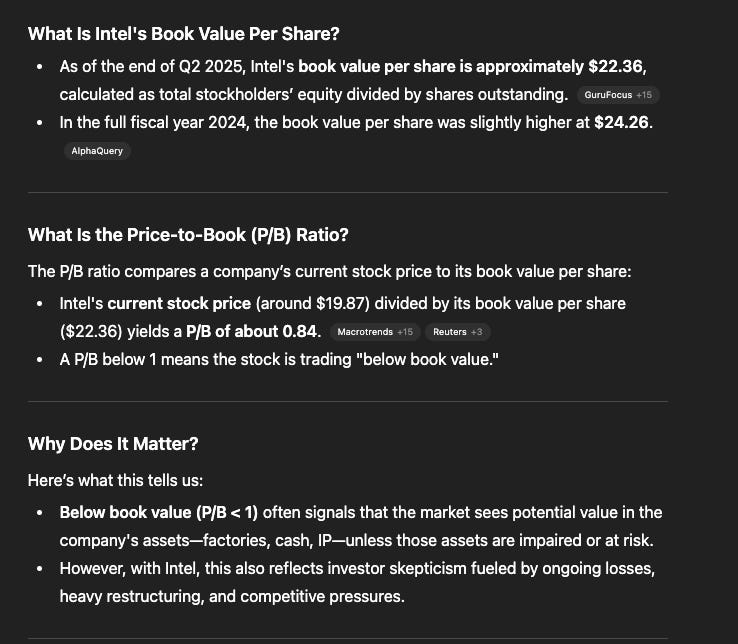

With the help of ChatGPT I looked into INTC’s price. At $19 it was trading below book value.

Book Value is Total Assets - Total Liabilities

Book Value is what would be theoretically left if the company sold everything and paid off all debts. To me it was what analysts might call “underpriced”.

At the time INTC was at $19. This felt seriously underpriced. There was a number of potential catalysts INTC had going for it. It also wasn’t far from the prior ~$24 book value. I needed to create a trade where I didn’t have to lock up all my capital to make a bet something was going to happen in a near but unknown future.

I ended up buying $24 LEAP CALL options for March-2026 and June-2026.

Why LEAPs?

LEAPs are a bet on both delta (change in price) and vega (change in volatility). $19 isn’t far from being ITM. $24 was the top of INTC’s range since August of 2024. Anything above $24 would leave my options ITM. I would have stock exposure with a much higher notional value while not having all my capital locked up. A LEAP offered me both time and convexity in direction. Any catalyst would drive both the price and implied volatility up, increasing the value of my options.

It was a better asymmetric bet than short dated options because they’re a bet on gamma (change in delta) and theta (change in time). That means despite needing less upside due to lower premiums I would have to be precise on both timing and price. I could make a lot more but it was closer to a lotto ticket. Where with a LEAP I have flexibility.

The traded ended up doing really well. I booked a 556% gain which added 20% to my portfolio’s equity side.

I got lucky that the events happened shortly after my buys. The first major announcement was the US Government investing in INTC. I felt it was too soon to let the options go. The train was only just getting going. I had optionality to wait it out because of the LEAPs.

Not long after came the NVDA investment news. My options were now deep ITM as INTC rocketed to $35. Interest in INTC was gaining momentum. This was when I decided it was time to sell my earlier expiries.

I sold the Mar-2026 $24 calls. The proceeds of which covered the entire cost basis of my trade plus some extra profit. Allowing me to ride the rest of my June-2026 call options with house money. Being deep in the money made it easy to ride profits as more good news flowed in.

A difficult thing for any trader is to accept when they no longer have edge. As INTC Q3 2025 earnings were coming up I felt I had reached that point. A lot of good news had come out. Sentiment had shifted bullish. But it was now more about execution than good news. Using the elevated interest heading into earnings I decided to sell the rest of my options. I may have given up a few final % upside but my concern was that the trade was getting crowded. Expectations were higher any kind of disappointment would erase months of patience.

I closed the rest of my INTC trade at $37.

Recent Yen trades:

Profit: -8.8%

As I’ve talked about in my first portfolio update I love Japan. I trade Japanese equities and the yen as way to stay in touch with Japan. Earlier this year I made a killing being long the Yen from 150 to 140 during the Liberation Day volatility.

The summer was slower. I was bidding my time looking for opportunities when Jackson Hole happened. Powell leaned dovish while Ueda came off hawkish with commentary like: “Labor markets in Japan continue to tighten.”

It wasn’t much to go on but it had me intrigued as the Yen was back near its 150 USDJPY levels. Most of August the Yen had been chopping between 146 and 149. I took the middle of the chop to build a small long position at 147 USDJPY betting on markets pricing in a potential Oct hike.

Shortly after during the September BoJ meeting I saw that there were 2 dissents in favor of hiking rates. I felt more confident towards a hawkish October so I increased my size to a moderate position to ride into Oct/Nov.

The sizing of my position was my first mistake. It wasn’t big enough to hold my attention. I thought I could drift into the Oct BOJ. What I hadn’t realized during that time was the change in Japan’s prime minister could lead to a change in status quo. Japan frequently goes through Prime Ministers but this time the strongest candidate was a major fiscal dove from the LDP: Sanae Takaichi

Takaichi’s platform centers on aggressive fiscal spending and stimulus to revitalize Japan’s economy. Prioritizing investments in growth while boosting defense spending. This puts a lot of pressure on BOJ to hold rates rather than raise them.

My second mistake was I held the losses when I should’ve cut them the moment Takaichi was in the lead. The Yen gaped from 146 to 149. At 149 I had a chance to not only get out with minor losses but reset. I could have switched to the short side once it broke the prior 150 levels. Instead, I held onto a stale thesis hoping for some kind of bounce to exit on.

The Yen quickly breached 150 plummeting to 153 pushing me out of my contracts on the way down. By the time Yen landed at 153 I was flat. It was here I felt as though a bottom may be forming. I moved on from the loss to focus on what was in front of me. With such a violent move from 149 to 153 the Ministry of Finance could have intervened to “stabilize volatility”. I decided to get long at 153 hoping for a small push to 151 or 150.

I got lucky as I went long at 153USDJPY several things happened:

Trump threatened China with a 100% Tariffs

Komeito, a long time coalition partner of the LDP chose to NOT back Takaichi. Meaning she had to find the votes from the other coalitions to cross lower house majority.

These events became a tailwind pushing Yen back to 149. An added bonus during this time was managing to get a few MES(Micro-ES) stink bids on the Friday October-10th sell off. I chose micro because of how violent of a sell off it was. I wanted low leverage and size. I was willing to carry risk overnight into a closed market until Sunday futures open. Betting by Sunday things would have smoothed over.

On both trades I managed to get lucky. I was able to close out of everything by Sunday evening clawing back some of my earlier losses with a few important lessons learned.

I have to be aware of my sizing. If it’s too small I might drift into autopilot not paying as much attention as I should be.

The moment my thesis has gone stale I need to cut my losses. The sooner I can mentally reset the sooner I can find a better opportunity instead of crying over spilled milk.

Had I cut my losses immediately I would have had 3 separate chances to not only make back my losses but compound profits.

The short from 150 to 153 on the Yen

The long on 153 to 149 on the Yen

MES stink bids on Oct.10th sell off.

Onwards and upwards.

The following is my personal commentary for informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security, and I am not a licensed investment adviser. Investors should seek independent professional advice before making any investment decisions.