Portfolio Updates - November.03.2025

The beginning of my portfolio discussions.

Current Portfolio Snapshot:

My most concentrated bets: HYPE

Crypto: 69% (nice)

HYPE: 85%

ETH: 8%

BTC: 7%

Equities: 17%

UNH: 51%

META: 24%

MU: 14%

AMZN: 9%

INTC: 2%

Active Trading Book: 14% (perps & futures)

ZT: Long

6J: Long

Flat on perps

Options:

HYG $79 Puts for Dec.2025 and Mar.2026

Portfolio Reflections:

Don’t tell me what you think, tell me what you have in your portfolio.

Nassim Taleb

Since this is the start of my portfolio updates it’s important to address two things about the portfolio:

What’s the mission?

What’s my competitive advantage?

People participate in markets for a number of reasons but I believe it can be condensed into two modes:

Capital Accumulation or Capital Preservation.

My mission is capital accumulation. Why beat around the bush? I’m here to get rich.

This means one thing:

TAKING AGGRESSIVE RISK.

Aggressive risk means I’m not interested in diversification. I don’t care about safe bets. I don’t want a few percent yearly returns. I’m looking to take big swings when I see them.

In my thinking, concentrating your bets decreases your overall risk because if you have a big, massive position, it has your attention. My favorite quote of all time is maybe Mark Twain: ‘Put all your eggs in one basket and watch the basket carefully.’ I tend to think that’s what great investors do.

Stanley Druckenmiller

The ability to take aggressive risk is part of my competitive advantage. I’m not afraid of risk. Nor do I use risk as a way to feed myself dopamine. I don’t care if I lose it all I just want to know what I’m capable of.

My edges comes from my ability to listen to my gut. I trust my instincts more than my mind. I’m often early to trends. I intuit a narrative forming before others. I can sense how others will feel & act before they do. What I’m not however is detail oriented. I’m not big on numbers or valuation. I know this about myself so I try to stay away from games I can’t win.

Being a big picture guy means my game is played by observation. I’ll take my time watching markets develop. I’ll explore any alley I can to understand what story is developing. I’m willing to trade any instrument. It doesn’t have to be just stocks. I’ve traded SOFRs, Yen currency futures and a number of other derivatives. I’m aware I’m often a tourist in these arenas so I’m cautious about overstaying my welcome. Sometimes, my gut will lead me to the edges of what’s investable such as betting big on NFTs or Pokemon cards.

I don’t care about my image as a trader. I only care about making money. Absolute returns matter far more to me than relative. I will participate anywhere there’s an opportunity to make money. It’s all one big adventure to me. Being involved in markets feels like I’m living inside the epic fantasy novels I used to read as a kid. It’s a lot of fun for me.

My Current Bets:

Let’s start with my most concentrated bet:

HYPE.

I’ll link my longer Hyperliquid thesis later but I believe the perps narrative is in early innings. Perps are a solution for a number of participants in crypto. TradFi firms have an easier time providing liquidity using order books rather than AMMs. Traders can use perps as a way to hedge exposure and earn yield in a number of ways. And for active traders perps are a better tool for leverage than memecoins, nfts, amm coins, leveraged ETFs & things like 0dte options.

Every few years crypto rotates from one casino to the next. We started in DeFi Summer of 2020, moved on to NFTs from 2021 to 2022 and then saw the rise of Memecoins from 2023 to 2024.

These assets inherently have leverage built in. They provide high beta for eager traders but are very illiquid. I doubt many care about the asset underneath. They just want exposure to the beta offered. During a time of high volatility these high beta assets provide a lot of excitement. Perps becomes a better tool to express these trades than owning the underlying asset by offering a more liquid ability to get in and out of the trade.

There is a similar effect in futures & options. Traders chase beta. Hungry for leverage. They care little about taking delivery of the asset underneath. Futures provide a very liquid market at 23/5 hours vs equities that only offer access 9:30-4pm ET on open business days.

Hyperliquid offers an elite perps trading solution. Their venue is efficient, liquid and transparent. I’m not worried about getting liquidated on a scam wick. It has proven resilience in times of high stress in the market. They also offer spot trading via Hyperunit, an EVM and custom liquid perps by way of HIP-3. All with lower fees than what may be offered on an opaque centralized exchange.

Unlike many crypto projects Hyperliquid generates income. They drive value back to $HYPE holders via buybacks from that income. It’s a fee generating monster. As of recent stats the daily fees ranges from $3M to $4M a day. That’s annualized to a yearly revenue of ~$1.5B. All of which is driven into buybacks. Consider that these fees are generated regardless of the market’s direction. Even in downturns income will be generated from traders who are hedging, closing trades or entering shorts. A lot like CME or trading desks at big banks that make much of their revenue during periods of heightened volatility.

Right now, there’s little else that excites me in crypto. I don’t care much for this privacy narrative. I would rather just trade the privacy coins on perps until it rotates to something else. (Another advantage of perps is the ability to quickly rotate from one meta to the next).

My ETH and BTC spot are both held on Hyperliquid. I use them to airdrop farm HypeEVM protocols as well as park my cash in crypto until opportunities strike to deploy more into HYPE. With the launch of HIP-3 I see more upside for HYPE. It’s exciting times to see what new products get built on top of custom perps. Such as Equity Perps and Pre-IPO perps. Because of this I have only taken some profits around $50 and continue to ride the rest while using HYPE perps to hedge exposure on downswings.

Onto the rest of the portfolio:

EQUITIES

In equities UNH dominates my allocation. Now as I’ve said before I’m not much of a valuation or stock analysis guy. My thinking was that a 61% drop YTD on a low beta stock like UNH meant much of the bad news was priced in.

I entered at $305 thinking:

UNH dividend was close to 3% at that price. This is while anticipating FED to begin their cutting cycle soon.

At 3% yield my cash is at least matching the inflation rate while being exposed to the upside of a turnaround narrative.

This would allow me to park my cash with exposure to the upside while planning to sell shares as needed to fund new trade ideas.

Of course the 13F filings certainly don’t hurt when you’re in the company of Buffet and Tepper.

As for the rest of my allocation:

This has been a year of change. The status quo has shifted. With that comes a lot of volatility. Which makes it difficult to anticipate what might be ahead. With low visibility conditions it has been hard to hold positions for any period of time. Outside of HYPE I’ve had a tough time settling into any single trade.

At first my trades revolved around defense and LNG. A basket I wish I was still in as the year has played out. I’ve jumped around more than I like. Over the summer I was in neutral until August when I started to buy the dip on LLY while allocating the rest into UNH. With the end of QT coming as well as the FED now on a slow but steady cutting cycle I’ve rotated some of my profits back into growth.

Q3 earnings have done well. It’s clear there’s some AI fatigue. Investors are less starry eyed about the possibilities of AI. They want to see a ROI on these huge increasing AI capex. Despite that fatigue AI build outs have also generated a lot of business. Banks are back in deal making mode. Energy companies are providing a ton of power to these data centers. There’s pick and shovel opportunities to take advantage of.

Overall the rest of the market is also doing well. Consumer spending is stable. Healthcare has had a big boost this season. The trade negotiations have helped our exports. Many of the deals have revolved around buying our LNG as well as increasing defense spending. In my view there’s been a renewed wave of nationalism among many countries. Even Japan wants to boost defense spend to 2% of the nation’s GDP.

Though earnings in both Q2 and Q3 have done well it’s also important to note missed earnings have been getting punished. There’s more discernment from investors. They need to start seeing results. META, FI and a few others have been pummeled by poor earnings.

My current positions:

META:

META is nothing more than a mean reversion trade. I think it has oversold on post earnings. Meta revenue and profitability are solid outside of the one time tax hit. META has great margins from their ad network. I don’t see that ad revenue slowing down anytime soon. The one time tax hit plus skepticism ROI from AI capex feels overblown.

It’s impossible to time these things I got in around $646. I chose to own spot so I can ride out volatility as META finds a bottom.

AMZN:

AMZN is a short term bet that they will outperform earnings expectations. Seeing GOOGL and MSFT cloud rev both knock it out of the park it’s hard to imagine how AWS doesn’t do well. Also, a lot of the spending data I’ve seen has shown consumers are spending more on e-comm than physical retail. Amazon dominates the e-comm space. With AMZN below prior highs it looks mispriced.

I entered this position at $230

MU:

This is an idea I’m fiddling with. AI capex isn’t slowing down tomorrow. Hyperscalers have increased capex for next year. Instead of trying to find the winning racehorse so late in the cycle why not bet on the picks and shovels that benefit from all this spending.

HBM (High Bandwidth Memory) is one of those picks and shovels. Demand is so high it has outstripped supply. HMB is sold out until 2026 from all 3 main suppliers: Micron, SK Hynix and Samsung.

In trying to find a way to invest in these pick and shovels I first considered LRCX, KLAC and AMAT. Talking with GROK at length. I was worried about the China exposure. Instead settling on on MU due the lowest valuation at 9.8x forward P/E vs semis 25x forward P/E.

The best risk/reward might be in SK Hynix. There’s an added bonus if KRW strengthens against USD. This is something Gundlach has talked a lot about. Investing in foreign stocks with the local currency. I’ve mulled on it but SK Hynix also has China exposure.

I worry about China exposure because China has been pushing self-reliance to minimize dependance on US or Western allies like South Korea.

I’ve been entering MU ~$200

OPTIONS

HYG $79 PUTS - DEC.2025 & MAR.2026

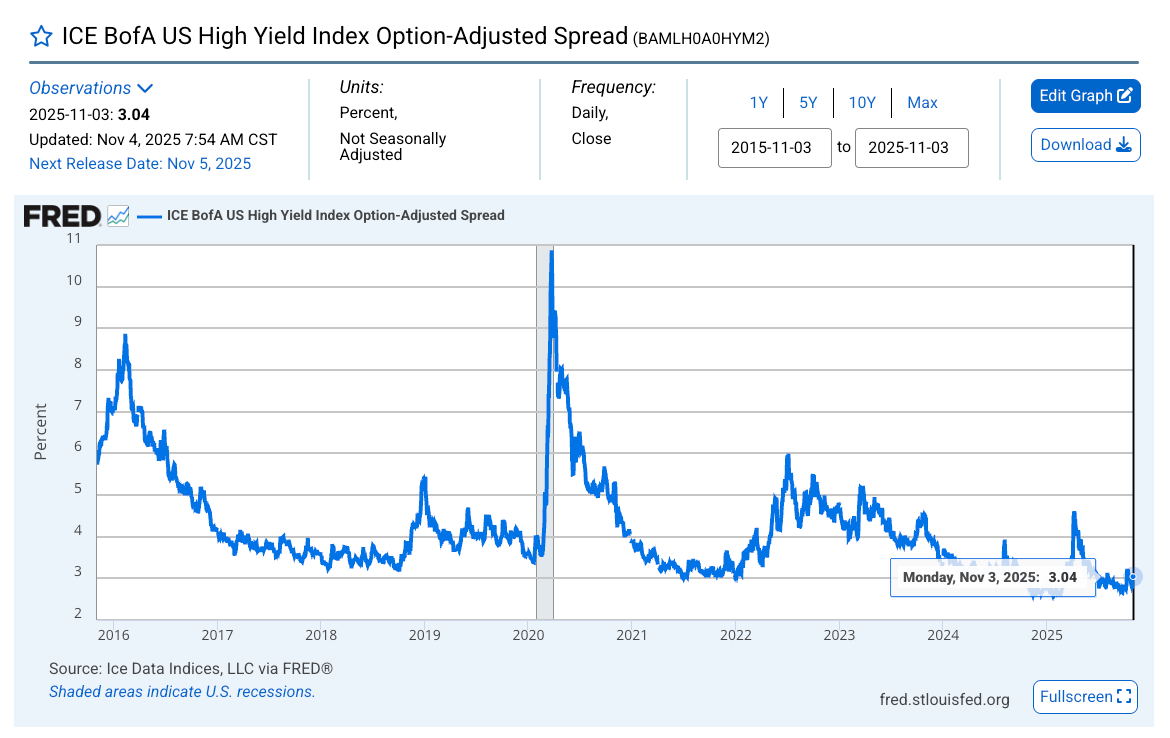

This is more of an insurance policy. Credit spreads have been tight. They’re as low as they’ve been in 10 years. But you never know when cracks will appear. The spreads feel too tight with how long we’ve had high rates for. During JPM’s earnings we heard about the Tricolor write off.

As Dimon said: “When you see one cockroach, there’s probably more.”

On the heels of that earnings call, drama has unfolded around several regional banks with bad fraudulent loans on their books. Thinking about this a bit deeper there could be second order effects. Especially, in the auto lending business. Consider there’s a large number of deportations happening. Many of those deported had some form of a high interest loan on their cars/work trucks. Payments they’re obviously now unable to make. Or they could have just left with the vehicles with no plan to return. Leaving the lenders unable to recoup their losses.

Another dynamic is that parts on newer cars are so expensive that often the car gets totaled out instead of repaired. Auto insurance premiums are only going higher. Insurance rarely pays out the full value of the car. So now an owner must get a new loan on a even more expensive new car with higher interest rates than their original loan. Mix that with an increasing number of layoffs and it could lead to some concern.

Seems like there’s potential for spreads to widen. I like the risk/reward so I’ve put on a few bets.

FUTURES

ZT LONGS

My ZT longs are a bet that once the government shutdown fog clears we will see a further drop in labor. Many of the earnings report this quarter were about cost cutting measures. Seeing huge lay off numbers at AMZN, INTC, etc. So I think despite a hawkish Powell on a Dec cut we will see the markets price that back in.

I prefer to be in ZT over ZN due to the fact we are so focused on immediate FED cuts. Going into next year I am sure we see the curve steepen with a new FED chair. I’d rather be in ZT over longer term.

YEN FUTURES

Ah the Japanese yen, a favorite trade of mine. I’m often in and out of the yen. I think it’s naturally my love for Japan. I like to trade Japanese equities along with the yen as a way to have some skin in the game. It helps me stay on top of the news going on there. Right now my Yen trades are tactical.

The new PM of Japan is a fiscal dove. She wants to boost government spending. This pushes back rate hike expectations from Oct to maybe January of 2026.

(What’s interesting though is that there are now two dissents on the BOJ meetings asking for a hike. It’s pretty rare to see something like that in Japan. As quoted in Fast and Furious Tokyo Drift: “The nail that sticks out gets hammered” . Seems like the culture in Japan is changing. I was shocked to see dissents. It’s something to keep an eye on.)

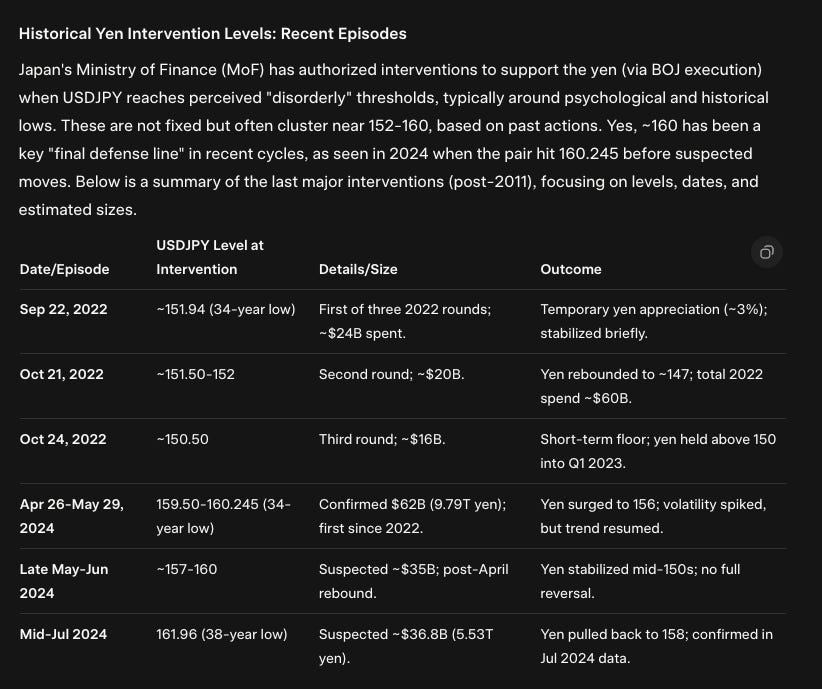

Anyways, now that the yen is past 150 there will be a point where the yen will weaken too much. As carry traders pile into shorts pushing Yen down further it will force Japan’s Ministry of Finance hands. This has happened a few times in the past.

And they recently put out a report they’re keeping an eye. Let’s assume based on history it will be closer to 157 - 160 levels since we are well past the 150.

Now my advantage here is I can be a nimble little fish in a vast ocean. I can ride along the waves created by bigger whales unlike a large fund that may have a more difficult time maneuvering. I plan to strategically allocate Yen Future longs at opportune times to ride intervention spikes along with any risk off moments that led to a flight into the yen. They’re small trades but profitable.

With Yen near chopping around 154 on the hourly chart it’s a good spot to open small size.

Recent Trades:

My recent trades are linked below.

The following is my personal commentary for informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security, and I am not a licensed investment adviser. Investors should seek independent professional advice before making any investment decisions.